Investor's Business Daily's Market Pulse / Current Outlook Fails as a Market Timing Indicator

(Note: This review was first published on July 6th, 2013, and has been updated here, 9 years later, on September 20th, 2022. Our original conclusions have been proven correct, and the IBD ETF Strategy has gone on to deliver poor returns for its followers, during a very strong bull market.)(see critique below)

Introduction

Investor's Business Daily® (IBD®) is a widely-distributed financial newspaper of record in the United States. It promotes an investing strategy, "CAN SLIM®", developed by its founder, William O'Neil, and promoted in his best-selling book "How To Make Money In Stocks". CAN SLIM is an acronym for the 7 items in its checklist for analyzing individual stocks.

While the C, A, N, S, L, and I are all fundamental analysis related, the "M" is essentially a technical analysis check. The "M" in CAN-SLIM refers to "Market Direction", or trend, and is published daily in Investor's Business Daily, in the Market Pulse section of The Big Picture. The Current Outlook (M) is determined by a running tally of Accumulation days (indices UP, in high volume) and Distribution days (indices DOWN in high volume), then subjected to some subjective committee review. Many CAN SLIM practitioners use IBD's Current Outlook as a market timing signal.

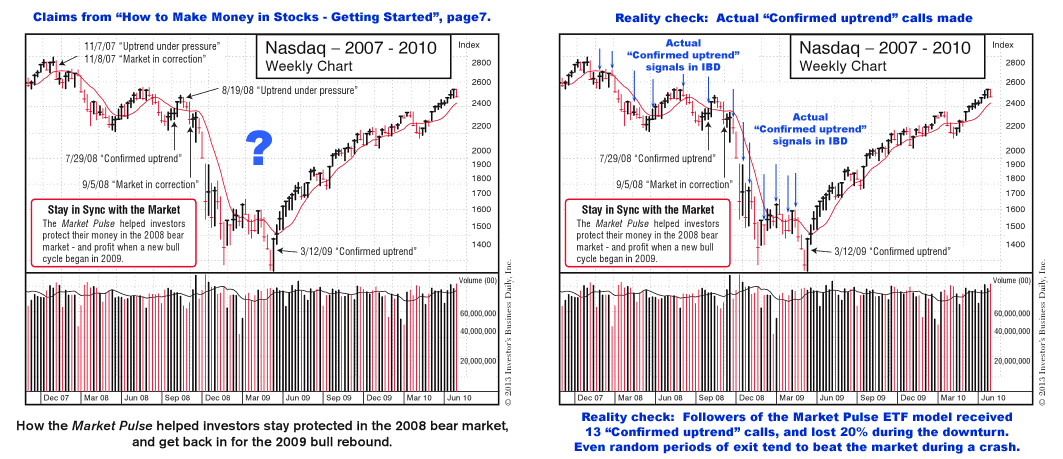

In 2013, IBD began touting its use as a market timing indicator, in "How to Make Money in Stocks - Getting Started", by IBD's Matthew Galgani, with an introduction by IBD founder William O'Neil (hereinafter Getting Started). In the first chapter, they present a market timing system, trading index-based ETFs according to their Market Pulse reading, claiming "Based on that (Market Pulse), you can see if it's time to buy, sell, or hold an index-based ETF"[1], finishing with "Now that we've seen how you may make substantial profits investing in index-based ETFs, ..."[1]

Well, under the Fair Use provisions of US Copyright Code, we decided to put IBD's Market Pulse - Current Outlook to the test, to educate followers as to its effectiveness in timing the market. The above chart shows this study in graphical format. The yellow line in the 2nd chart numerically represents the Current Outlook, as published in IBD, in a standard technical analysis format.[2]

In the most favorable interpretation, this timing model exited the market at any "Correction" (+1 value), and re-entered at any "Confirmed Uptrend" (-1 value). It sold half its position whenever the Market Pulse changed from "Confirmed Uptrend" to "Uptrend Under Pressure" (+0.5 value). In this test, we did not study the effect of stop orders.

Critique

As you can see, using the IBD Market Pulse / Current Outlook as a market timing signal was not effective. It did smooth out some of the peaks and valleys, but, for long periods, did not beat a buy-and-hold strategy. This is common for most trend-following systems, which are reactionary and not predictive, and change direction only after the trend has already reversed. As seen in the IBD study above, a follower typically re-enters the market at about the same level, or at an even higher level, than they exited previously. Trend followers rarely beat the market, especially in noisy bull markets. The above chart uses the QQQ ETF as the benchmark, as it represents the closest basket of stocks typically purchased by CAN SLIM practitioners. The book's claim, "How IBD's Approach Nearly Doubled the Nasdaq Performance" [1], is already dubious. Strike 1.

Now, we must address a few glaring omissions in the "Getting Started" ETF study. First, astonishingly, IBD neglected to account for dividends in their study. Dividends are an important part of any index's return, and should never be ignored. The chart above accounts for dividends while in the market, and interest earned while in cash. Strike 2.

Next, we are troubled that IBD seemed to cherry-pick the sample period in "Getting Started", starting just before the market selloff of late 2008. From 2003 through September 2008, the IBD model underperformed the market. From November 2008 through today, the IBD model again underperformed the market, giving back any advantage gained during the crash, and then some. So, remove that short 7 week period, and the IBD model failed miserably. The fact that the IBD model beat the market during that sharp selloff could easily be attributed to coincidence. During such a steep, steady decline, even random periods of exit would typically beat the market. The correlate is true during periods of sharp rises; Random exits would cause the returns to underperform the market, as has been the IBD case during bull markets.

In subsequent presentations of the IBD ETF system, IBD chooses a longer time frame (2003-03-07 → 2013-03-29) {UPDATE: As of today, 2020-10-15, for reasons unclear, they are using 2005-10-20 → 2020-07-31}. One should note the long periods of underperformance during most timeframes. In both "Getting Started" and their 10-year model, they've cherry-picked the dates to present a rosier performance. Strike 3.

Next, using the Nasdaq Composite Index gives the IBD model its best performance. In the study above, we use the QQQ ETF as it most closely matches the basket of stocks traded by CAN SLIM practitioners. If one were to choose a broad ETF, like SPY, the performance is MUCH worse. Strike 4.

Finally, and much more suspect, it is important to note that Market Pulse called "Confirmed Uptrend" 13 times from the peak of 2007 to the trough of 2009, suffering its own drawdown of more than 22%. The book would mislead a reader into thinking that IBD called a "Correction" on 2008-09-05, and reentered the market with a "Confirmed Uptrend" on 2009-03-12. What they hide from the reader is the fact that IBD issued a "Confirmed Uptrend" signal 7 times during this period, and almost all failed. See chart below, which is a markup of their original chart.[1] We find these omissions HIGHLY misleading. Strike 5.

To the folks at IBD, we highly recommend, and strongly encourage you to read, a book that may forever correct your thinking and faulty analysis: "Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets",

[1] Galgani, Matthew (2013). How to Make Money in Stocks - Getting Started. [pp 5-8]. Retrieved from http://books.google.com.

[2]We have done our best to make sure these values are accurate, but, since we've had to harvest IBD's Market Pulse historical data from many different sources, they may not be completely accurate. Also, it seems the nomenclature used for the reading has changed over the years. In this chart, we've given IBD readings of "Correcting", "Correction", "Correct Taking Hold", "Nasdaq Correcting", "Confirmed Rally Dead", "Tech Rally Dead" values of +1. "Confirmed Rally", "Confirmed Up Trend", "Up Trend", "Resumed Up", "Back On Track" a value of -1. "Pressure", "Under Pressure", "Rally All But Dead", "On the Ropes", "CR - Caution", "Appears Back On", "Signs of New Life" values of +0.5. IBD presents more favorable results than we obtain through our calculations. But, after numerous attempts, we have been unable to get IBD to release their calculations for our review. We are not responsible for any errors or omissions.

Investor's Business Daily®, IBD®, and CAN SLIM® are registered trademarks of Investor's Business Daily, Inc.